If you must buy, sell, or manage crypto assets, you need a crypto exchange, as it is the primary access point to the digital asset economy. Simply put, crypto exchanges are platforms that enable investors to buy, sell, swap, and securely manage digital currencies with fiat. Over time, they’ve become instrumental to exploring decentralized applications (dApps) and non-fungible tokens (NFTs).

With hundreds of exchanges vying for the top spot, selecting a crypto trading platform that is secure, reliable, and suits your particular financial needs matters more than ever. To help you know more about cryptocurrency platforms, this article covers the dynamics of crypto exchanges, including how to choose the most reliable one for a better trading experience in 2025.

What is a Crypto Exchange?

A crypto exchange is an online platform that facilitates the buying, selling, and swapping of digital assets such as Bitcoin and Ethereum. These platforms connect users to the crypto market and offer tools for trading, managing, and earning crypto. Upon creating an account on an exchange, users can start trading different cryptocurrencies.

Cryptocurrency exchanges support both fiat-to-crypto and crypto-to-crypto transactions, making it easy to convert your fiat currencies into digital currencies or to transfer assets to a specific digital wallet. Depending on the type of exchange, assets may be held in user-controlled wallets or in any exchange operating system.

Exchanges also offer great features such as spot trading, futures contracts, staking rewards, and even NFT marketplaces. Some exchanges even display real-time data and provide advanced charting tools to help traders make informed decisions.

How Does a Crypto Exchange Work?

The operation of a crypto exchange requires step-by-step processes that match buyers and sellers to facilitate trading. However, you must first sign up, verify your identity with a quick KYC check, and link your bank account or wallet. After account approval, you can deposit funds, either by fiat money through a bank transfer or crypto straight from your wallet.

When you place an order to buy or sell cryptocurrency, the exchange’s order book finds a matching order from another user, connecting you both. This happens automatically through a high-speed matching engine that finds compatible trades within a second. Once a trade is complete, centralized platforms hold your assets securely, while decentralized ones send them directly to your wallet.

To withdraw cash to your bank or move crypto to another platform, you may be required to pay a certain fee. Fees apply to most transactions, but luckily some exchanges offer zero trading fees on special trading pairs and products.

Types of Cryptocurrency Exchanges

There are several types of cryptocurrency exchanges, each catering to different user needs, including:

1. Centralized Exchanges (CEX)

Centralized exchanges are run by third-party companies or exchange operators, which hold your funds in custodial wallets and process trades through internal order books. They ensure that you create an account, complete KYC, and the platform matches your buy and sell orders while managing liquidity and security.

This exchange type usually supports trading of digital assets with both fiat currency and other cryptocurrencies. They also provide additional features for traders to practice their strategies and also automated tools for investors who want to run their trades 24/7, making them popular with beginners and active traders.

Pros

The pros of centralized exchanges are listed below:

- High Liquidity: CEXs attract massive trading volumes from large user bases, enabling quick execution of buy and sell orders at stable prices without significant slippage, which is ideal for high-volume trades.

- User-Friendly Design: These platforms feature intuitive interfaces, mobile apps, and simple onboarding, making them accessible for beginners while supporting advanced tools like charts and real-time data.

- Advanced Features: CEXs provide fiat on-ramps, margin trading, futures, staking, and customer support, plus a wide range of assets, including altcoins not always available on DEXs.

Cons

The cons of centralized exchanges are listed below:

- Security Vulnerabilities: CEXs hold user funds in centralized wallets, making them prime targets for hacks and theft

- Custodial Risks: Users lack control over private keys, relying on the exchange’s solvency. This means that platform failures, freezes, or shutdowns can lock assets indefinitely.

- Privacy and Compliance Issues: Strict KYC/AML requirements expose personal data, reducing anonymity and raising surveillance risks.

2. Decentralized Exchanges (DEX)

Decentralized exchanges let you trade directly from your own wallet without giving central authority to the company. Instead of a central order book, most DEXs depend on peer-to-peer (P2P) trading or on-chain order books to set prices and execute swaps between token pairs. You will be able to control your private keys, but you are responsible for securing them, as anyone who has them can access your account.

Pros

The pros of decentralized exchanges are listed below:

- User Control: Traders retain custody of private keys and funds in personal wallets, eliminating reliance on a central entity and reducing custodial risks.

- Privacy: No KYC requirements preserve anonymity, as trades occur directly without the submission of personal data.

- Transparency: All transactions are record on-chain, verifiable by anyone, with no intermediary manipulation possible.

Cons

The cons of decentralized exchanges are listed below:

- Lower Liquidity: Smaller trading volumes can lead to price slippage and slower execution, especially for niche tokens.

- Complexity: Steeper learning curve for beginners, requiring wallet management and understanding gas fees.

- Limited Features: Often lack fiat on-ramps, advanced tools like margin trading, and customer support.

3. Hybrid Exchanges

Hybrid exchanges blend elements of centralized and decentralized exchanges. It offers the high performance and liquidity of a CEX while providing the security and self-custody benefits of a DEX. These types of exchange also use an off-chain system for order matching, allowing quick trades without incurring immediate blockchain fees.

Pros

The pros of hybrid exchanges are listed below:

- Balanced Performance: High liquidity and fast trades from centralized engines, paired with user control over private keys via smart contracts, reducing custodial risks.

- Enhanced Security and Privacy: Non-custodial wallets minimize the risk of hacks while supporting regulatory compliance and anonymity features.

- Versatile Features: Access to fiat on-ramps, advanced tools, and cross-chain trading without full DEX complexity.

Cons

The cons of hybrid exchanges are listed below:

- Liquidity Challenges: May not match pure CEX volumes, causing occasional slippage for rare pairs.

- Regulatory Uncertainty: The Blended model faces evolving rules, risking compliance issues in some jurisdictions.

CEX vs DEX vs Hybrid Exchange: Comparison Table

| Feature | Centralized (CEX) | Decentralized (DEX) | Hybrid |

| Custodianship | Exchange holds custody of the user’s funds | Users retain control of funds via the wallet | Uses both custody methods, depending on the platform |

| Fiat Support | Yes | None | Limited |

| User Friendly | Intuitive and accessible | Complex and less intuitive | Balanced interfaces |

| KYC Required | Yes | No | Usually optional |

| Liquidity | High | Lower | Aggregates from different sources |

| Security Risks | Hacks | User error | Low custody risk |

How to Choose the Best Cryptocurrency Exchange

When choosing a crypto exchange, consider the platform’s security, available assets, transaction fees, and reputation.

1. Security

Security should be one of your top priorities when choosing a crypto exchange for your trading experience. The safety of your funds and personal information depends on the exchange’s security features. In addition to standard platform features, the best exchanges offer insurance policies and have reserve funds to protect users in the event of a security breach.

When choosing a centralized crypto exchange, look for options that support two-factor authentication (2FA), withdrawal address whitelisting, real-time monitoring, and other security measures to add an additional layer of protection to your account.

2. Transaction Fees

Another critical factor to consider when selecting an exchange is the fee schedule for deposits, withdrawal, trading, and even hidden fees. Compare trading, deposit, withdrawal, and spread fees, as they could impact how much of your profit fees eat up, especially for frequent traders. In addition, look for tiered discounts based on volume, task-based discounts for buying and selling Bitcoin and other assets, or loyalty programs to reduce long-term expenses.

3. Available Assets

With thousands of digital assets listed on major exchanges, most companies support just a few hundred assets, including major coins like Bitcoin, Ethereum, and Solana. However, lesser-known coins with smaller market caps may not be easy to find. Even if they are found, they may have less liquidity than other tokens.

So ensure the exchange you choose supports the crypto assets you want to trade. If you are primarily focused on trading lesser-known altcoins and newly listed tokens, explore exchanges that list tokens early before they are publicly available like MEXC and Gate.

4. Reputation and Reviews

Before you choose an exchange, research the exchange’s reputation and check out user reviews to determine its reliability and trustworthiness. User reviews on social media and review sites can give insight into the exchange’s performance and customer service. You can also look out for information on if the exchange has experienced security breaches in the past and how they resolved them.

List of Top Crypto Exchanges You Should Know

There are several cryptocurrency exchanges popular for their features, reliability, and user experience. Below are some of the best cryptocurrency exchanges widely used today:

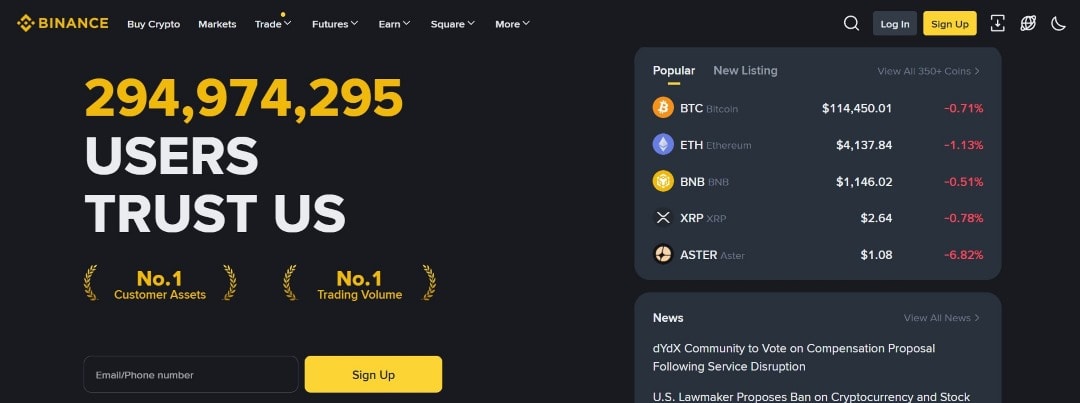

1. Binance

The Binance platform is the largest cryptocurrency exchange in terms of trading volume, liquidity, and user base. It was founded less than a decade ago, but quickly surpassed existing platforms and became the top choice for most crypto investors a few months after launch. Binance offers spot, futures, margin trading, staking, and earning products with low fees and high liquidity.

In addition to these features, users can access over 350 cryptocurrencies and trade 1,500+ pairs across spot and futures markets. The platform also provides tools like P2P trading, an integrated web3 wallet, and NFT marketplace. With all these extensive features, binance is limited in some regions, including the US. Nevertheless, the company offers Binance.US, a version strictly available to traders in the US.

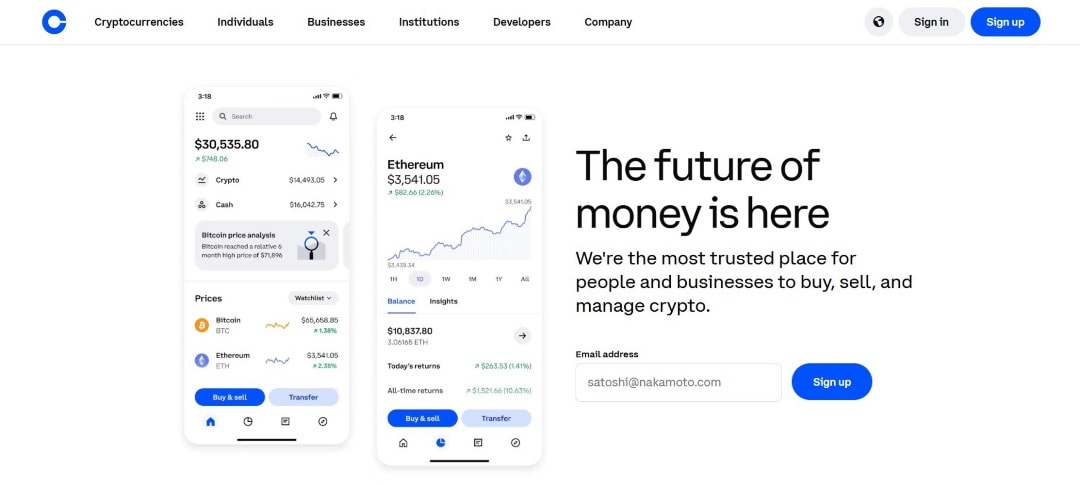

2. Coinbase

Coinbase is another popular and user-friendly exchange, best suitable for beginners. It offers strong security features, a wide range of supported cryptocurrencies, and a simple interface with Coinbase Pro. These features also include more advanced trading options with little or no fees.

3. OKX

OKX is among the top largest crypto exchanges by daily trading volume. The platform currently serves over 70 million users in 100+ countries, providing them with tools for buying, selling, and managing crypto securely. OKX supports trading, staking, and DeFi services for over 400 digital assets. It also offers spot, futures, options, and perpetual swaps with up to 100x leverage.

4. Kraken

Kraken is a top choice crypto trading platform for US traders who can’t access other platforms due to strict crypto laws and regulatory restrictions. Kraken was founded in 2011 by Jesse Powell and is a popular choice among traders due to its security and regulatory compliance.

The exchange supports trading of over 400 cryptocurrencies across spot, margin, futures, and derivatives markets, serving more than 15 million users in 190+ countries. In addition to these features, Kraken offers Kraken Pro for advanced traders with low fees based on volume, deep liquidity, and tools like staking, NFTs, and OTC services.

5. Kucoin

KuCoin is a cryptocurrency exchange that helps facilitate a global free flow of digital value. It supports futures trading, as well as a built-in exchange called P2P (peer-to-peer). You can also instantly buy cryptocurrencies using a credit card or debit card. The platform has over 20 million users and offers over 760 cryptos.

6. Bybit

Bybit is a leading crypto trading platform that specializes in derivatives products and services, like perpetual and futures contracts with up to 125x leverage. In addition to strong support for crypto derivatives, the platform supports spot trading, over 650 cryptocurrencies, and automated trading tools like copy trading and bots for efficient order execution.

Bybit is the world’s second largest exchange by trading volume and serves more than 78 million users in 240+ countries, excluding restricted regions like the US. Since launch in 2018, the exchange has gradually become a top choice for investors due to its user-friendly interface, competitive tiered fees, and other features including NFTs, staking, and a web3 wallet.

Are Crypto Exchanges Safe?

Crypto exchanges implement strong security measures to keep user assets safe. Before you use a cryptocurrency exchange to store or exchange your fiat and digital cryptocurrency, you should know that it can be very risky. Some exchange users have found that their assets are gone completely or indefinitely locked up without any financial backup plan.

When you put your digital assets on an exchange and do not have custody of your wallet, you are giving that exchange complete control over your assets. However, if the exchange has a reserved fund, and has proper measures put in place, you will experience lower risk. In most cases, there is no way for you to know if an exchange is healthy, trustworthy, or secure enough to use.

Crypto Exchange vs Wallet: Key Differences

Let’s compare the differences between crypto exchanges and wallets using different dimensions.

1. Purpose

A crypto exchange allows you to trade and exchange digital cryptocurrencies, while a crypto wallet securely stores them. This means that the exchange serves as a marketplace, while the wallet serves as a safe.

2. Ownership

Users who keep crypto on an exchange usually don’t have full custody of it because the platform holds the private keys. On the other hand, non-custodial wallets provide full control, making them the best option for long-term storage.

3. Security

Although most exchanges have security measures put in place, they remain attractive targets for hackers. Wallets, especially non-custodial ones, provide better security as only the user has control over the keys.

Conclusion

Different cryptocurrency exchanges offer different services for investors who may have specific needs in the crypto market. A beginner may prefer a more intuitive and easy-to-use interface, while an expert trader may choose an exchange that offers more advanced trading features. This is why knowing the various types of exchanges and how they work for your financial goals is crucial.

Choosing the best cryptocurrency exchanges involves evaluating security measures, fee structures, user experience, available cryptocurrencies, liquidity, reputation, and regulatory compliance. When you consider these factors, you can select an exchange that aligns with your goals, ensuring a safe and efficient trading experience.

FAQs

The best cryptocurrency exchange depends on your specific needs and priorities, such as security, ease of use, fees, and the available coins. If your goal is quick and simple buy/sell trades or access to advanced products like derivatives, centralized exchanges such as Binance, MEXC, or Bybit are the best fit.

Some crypto exchange platforms are safe due to their strong security, regulatory compliance, and history. Examples of platforms that use top security practices to protect user assets are Kraken, Coinbase, Crypto.com, and Gemini. However, a non-custodial cold wallet is usually a safer option than any exchange.

Yes. Crypto exchanges may charge users fees for services like trading, depositing, and withdrawing. Although some offer limited fee-free options or use subscription models, with varying costs across different platforms

Centralized exchanges are run by companies, offer easy fiat-to-crypto transactions, user-friendly interfaces, and high liquidity. However, the exchange holds your funds, which is risky. On the other hand, decentralized exchanges work with smart contracts on the blockchain and allow peer-to-peer trading with self-custody. It can be less user-friendly but offer more privacy.

Yes, cryptocurrencies can be easily converted to fiat like USD, EUR, GBP on crypto exchanges, allowing you to cash out into traditional money via bank transfers, debit cards, or P2P platforms, with major exchanges like Binance, Coinbase, Kraken.