In the last couple of days, the trade price of Bitcoin faced a significant downfall, despite the bull sentiments in the Crypto market.

The current trade price of Bitcoin is $97,127, which is -5.94% down over the last 7-day trading period. The significant downfall started after 31 Jan.

In the same period, the trade price of Ethereum ($ETH), second top-ranked Cryptocurrency, crashed by nearly -12%. The current trade price of $ETH coin is $2,843.

Just a couple of days ago, the trade price of Ethereum was fluctuating around $3,400. This means the price collapsed by nearly -16.5% in the last couple of days.

A similar pattern is also visible in the other top flagship cryptocurrencies like Solana (-20% crash from $241 to $192) and Cardano (-20% crash from $0.97 to $0.76).

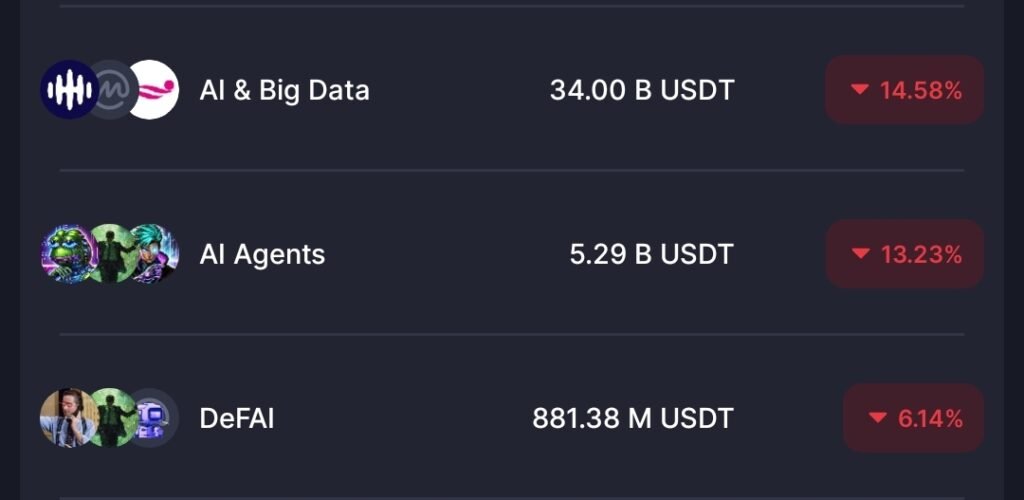

Top trending crypto tokens related to Artificial intelligence (AI) technology are also facing downfall.

Major reasons behind the price crash

In the present situation, the majority of the crypto experts are sharing their opinions in their own ways and claiming that the bull cycle is following its past pattern & we should not get into any type of panic and we should accumulate the best digital assets at a discounted price but, on the other hand, some top experts are suggesting people to not to follow price graph analysis on behalf of the past bull cycle, instead focus on the current ongoing economic policy developments in the US jurisdiction which is the initial phase of Trade war between different countries.

USA Hikes in Tariffs

On 1 Feb 2025, USA President Donald Trump introduced new tariffs on imports from Mexico, Canada, and China. So under new tariff hike measures, goods imports from Mexico and Canada in the US jurisdiction will face a 25% tax, while Chinese goods will be subjected to a 10%.

The Trump administration’s decision is focused on addressing several issues, for example, illegal immigration and fentanyl smuggling.

This latest measure around import tariffs by the US government clearly means that prices of various goods will increase rapidly. It will mainly impact the industry related to cars, food, and electronics.

Experts believe that the stock money market is highly dependent on tech companies’ stocks, so obviously it is a very big shock for the volatile money market.

Trade War Between Countries

In response to the tariff hike in the US, Canada also announced new retaliatory tariffs, while people are waiting for a response from Mexico and China.

Economists warn that these tariffs could raise inflation, slow economic growth, and ultimately harm American consumers and workers.

In particular, Peter Schiff, a popular Bitcoin critic & global economist, supporter of gold & silver investment, said that the increasing value of the US dollar is not a good sign for Americans because the US sector significantly depends on low-cost imports.

Kashif Raza, a popular Indian crypto influencer who has expertise in Indian laws, explained this development in more simple words and explained that the prices of raw materials in the US would be available at a high cost, as Canada is one of the biggest trading partners.

Also, the US has no plans to cut rates, so ultimately, it will lead to high prices for goods & services. All these things lead to less liquidity means less money flow into stocks and crypto.

Legal Tender Status of Bitcoin in El Salvador

Many experts joined the Bitcoin trade price crash event with El Salvador’s reformed Bitcoin Act, which removes Bitcoin’s legal tender status as a part of an agreement with the International Monetary Fund (IMF) body for a $1.4 billion credit line.

Read also: Bad News! Bitcoin Is No Longer a Currency in El Salvador