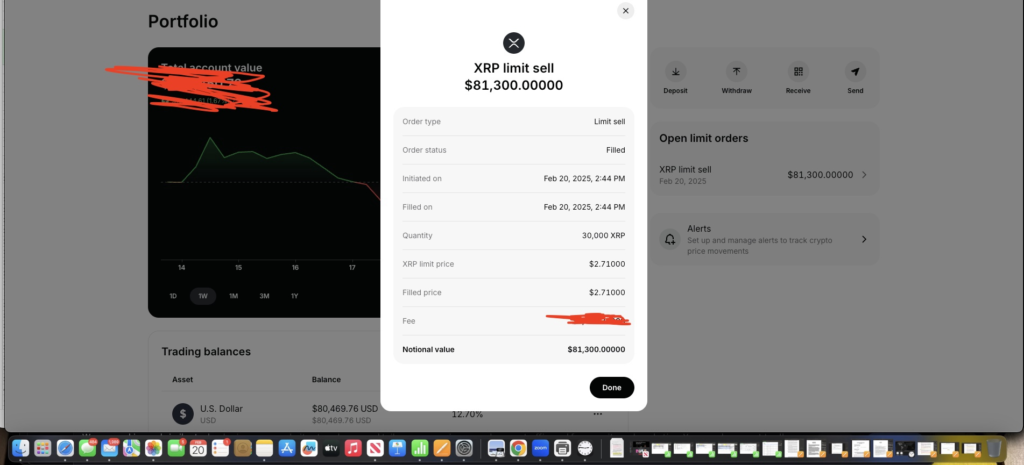

Twin brother of entrepreneur Grant Cardone, Gary Cardone has a lot of experience in investing, he announced that he sold his entire XRP position for a price of 2.71 dollars. Today he posted on X, Cardone, drawing from his 40 years of financial experience, mentioned his six personal investment rules as the driving force behind his exit.

In his post, Cardone told XRP investors he wishes “they get stupid rich,” but admitted he doesn’t think that will happen. “My best hope is out to each of you,” he continued.

The Chargebacks911 co-founder criticized the aptitude of some investors to focus on price rather than intrinsic value.

“Avoid people who know the price of everything but the value of nothing. Never confuse short-term noise with a long-term investment/plan/goal.”

American-born explained how he avoids assets with unclear supply-and-demand dynamics except if he has a significant advantage. He also stated that he chooses to steer clear if an investment cannot be “ drawn on a whiteboard.”

His final point supported his philosophy of avoiding the herd mentality, calling for investors to move clear of popular market trends.

“Never follow the crowd…Great wealth comes from consolidated, long-term bets,” he concluded.

XRP community responds:-

One X user going by the pseudonym Vantozio, argued that uneducated investors have unfairly dismissed the XRP community. Cardone’s statements drew overwhelming numbers of thumbs-down responses from XRP supporters. While riding on allegations he wrote “We have held through years of an SEC lawsuit that was undoubtedly an untruthful and misleading case lobbied by holders of the Ethereum Foundation,” with the help of former chairperson Gary Gensler, directed the agency to target Ripple.

Other people questioned why the entrepreneur bought XRP, criticizing him for breaking the rules he had listed. One disappointed XRP supporter said “You posted those rules… yet bought at some point… you don’t even follow your own rules.”

In December 2020 question of XRP’s nature, especially regarding centralization, began to discourse, when the SEC filed a claim on Ripple for offering the token to investors as a security.

Gary claims that because Ripple selects these nodes, it controls the network. However, one argues the entity does not control all validators.

The user demonstrates that only 2% of XRP validators are owned or operated by Ripple. Ripple gives reasons that XRP’s Network is vastly more decentralized than BTC and ETH.

Jason Calacanis angel investor declared in a very way that he is not supportive of the SEC’s hints at approving a spot XRP exchange-traded fund (ETF), warning that it could “make securities law will worthless.”

Jason Calacanis predicted that “There will be chaos in the markets as a million startups, funds, and grifters start dumping 50% of their coins on retail while slowly selling the 50% they own and control.”

Jason Calacanis ended his post by saying XRP should be limited to those investors who fully understand the risks associated with the token.