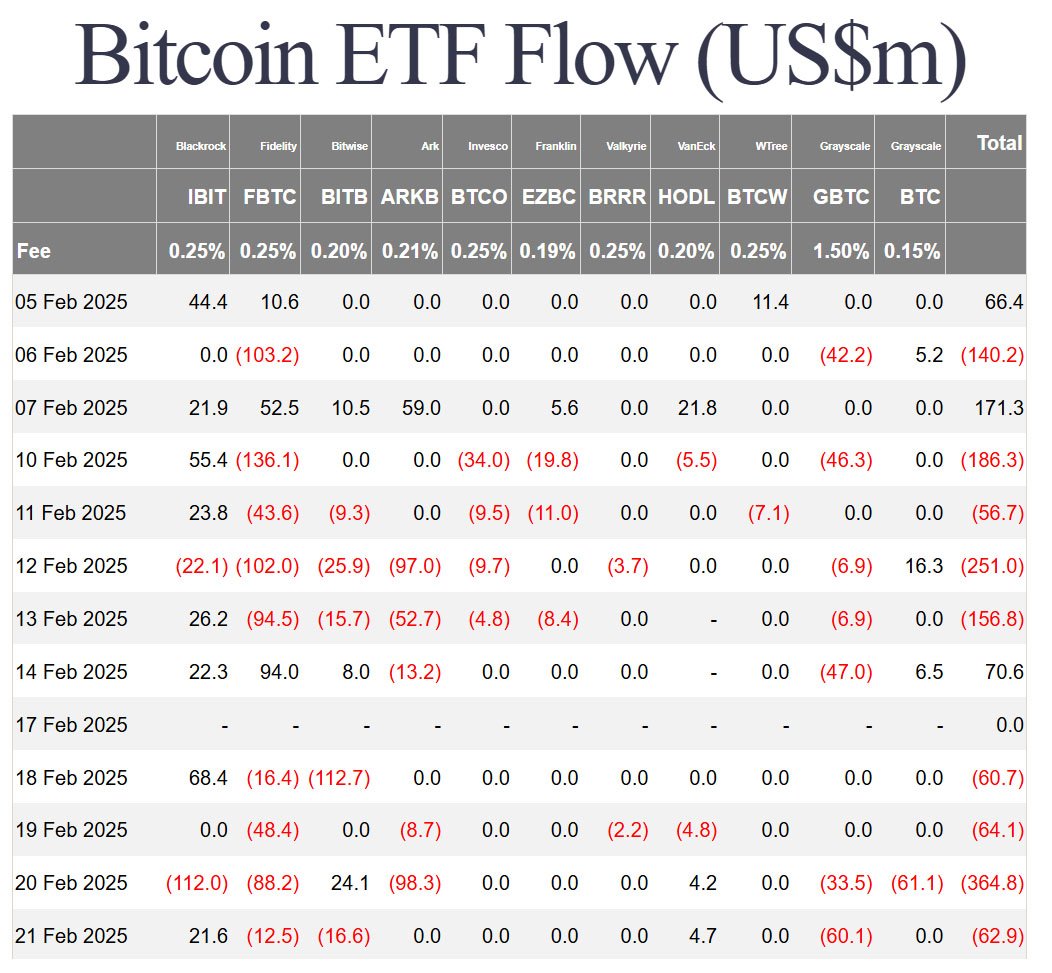

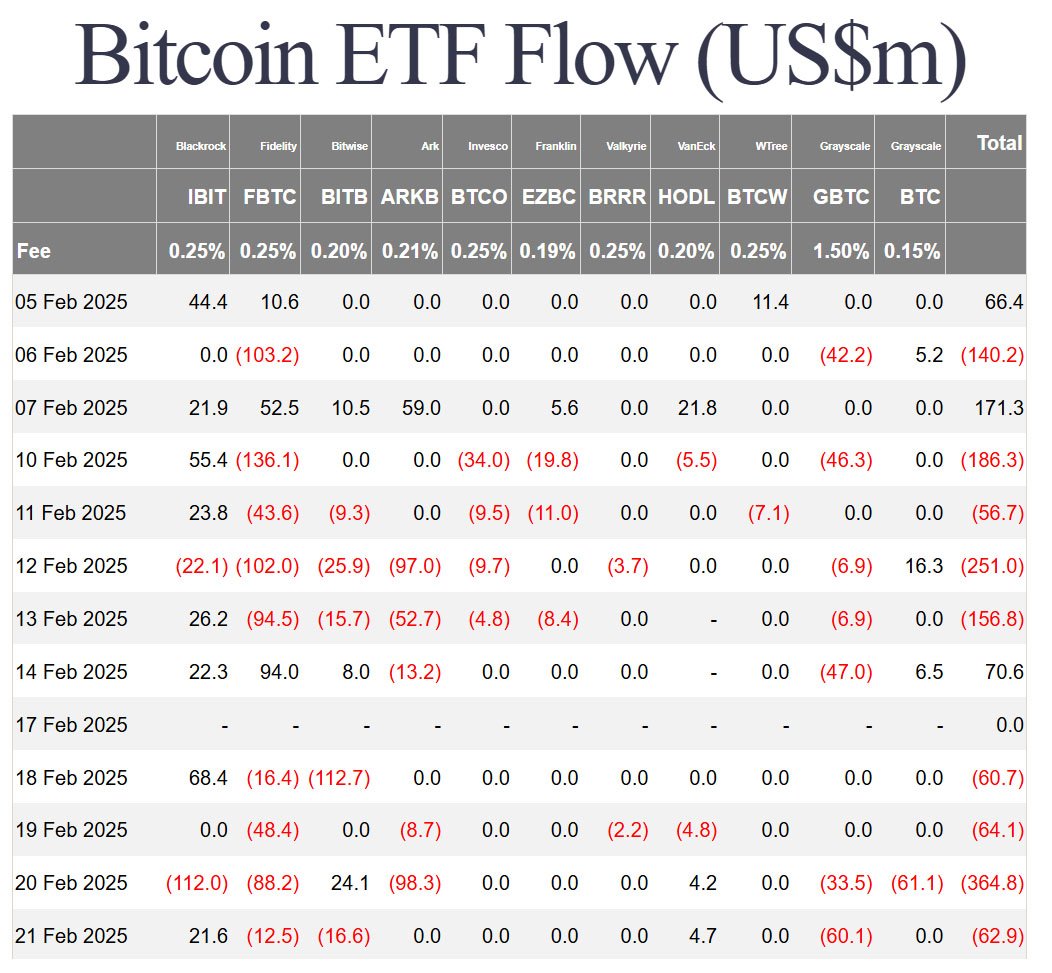

US Bitcoin ETFs saw their largest two-week outflow ever, with over $1.14 billion leaving the funds as investors react to growing US-China trade tensions. The two-week outflow is the largest since Bitcoin ETFs launched in January 2024.

February has been a bad month for Bitcoin ETFs, with most days in the red. According to Farside Investors, Bitcoin ETFs have seen outflows for 9 of the last 11 trading days. The largest single-day outflow was on February 20 when $365 million was pulled out.

Grayscale’s GBTC was hit hardest with $60.08 million in outflows on February 21. BITB and FBTC also saw significant outflows of $16.58 million and $12.47 million respectively. But IBIT and HODL held strong with inflows of $21.64 million and $4.71 million respectively.

Analysts believe the big decline in Bitcoin ETF investments is tied to economic uncertainty, particularly US-China trade tensions. New import tariffs have spooked investors and many are pulling their money out of Bitcoin ETFs.

Market participants are waiting to see what comes out of the meeting between US President Donald Trump and Chinese President Xi Jinping. Trump said a new trade deal is “possible” but didn’t give a timeline, adding to the uncertainty.

Beyond trade concerns, other factors are at play. Markus Thielen, head of research at 10x Research, points out that many ETF investors use these products for short-term arbitrage rather than long-term holding.

He says only around 44% of the inflows are genuine long-term investments, so maybe bitcoin’s real demand as a long-term asset isn’t as strong as thought.

Kadan Stadelmann, CTO at Komodo Platform, notes that some investors are moving their funds from Bitcoin ETFs into more stable assets like gold.

He also points out that Berkshire Hathaway’s record $334.2 billion cash reserve means the company is preparing for a market dip, which could mean broader economic concerns.

Despite the sell-off, some still hold a positive long-term outlook. Marcin Kazmierczak, co-founder and COO of RedStone, says looking at short-term doesn’t give the full picture.

“ETFs are generally considered long-term investment vehicles, so analyzing flows over a six-month or yearly period gives a more meaningful perspective”, he says. He adds that when looking at the bigger picture, net flows into Bitcoin ETFs have been overwhelmingly positive.

Related: BlackRock’s IBIT Sets Record as “Greatest Launch in ETF History”

Kazmierczak also points out that institutional investors like the Abu Dhabi Sovereign Wealth Fund and Wisconsin’s Pension Fund still hold big bitcoin positions through ETFs despite the outflows.

Bitcoin’s price has held steady despite the ETF sell-off, ranging between $94,000 and $99,000. Nevertheless, some analysts say the ETF outflows are an early warning sign of a bigger market sell-off.

While bitcoin ETFs are having their worst month ever, the bigger picture still shows institutional interest in bitcoin is strong.

Trade tensions, economic uncertainty and shifting sentiment are causing short-term volatility but long-term investors remain bullish. As the global economy evolves, bitcoin ETFs will be the canary in the coal mine for institutional sentiment on the world’s most scarce digital asset.