On Jan. 16, San Francisco-based financial technology company Ripple Labs’ CEO Brad Garlinghouse joined panels of prominent speakers at the CfC St. Moritz blockchain conference held in the Swiss Alps.

There, he suggested to audiences that certain digital assets, including Ripple’s xrp currency token, could soon be incorporated into a not-yet-realized United States strategic reserve.

Garlinghouse made a casual reference to the possibility, saying: “… With the largest capital markets finally embracing crypto and I suspect rather imminent US regulatory clarity, a step function change in adoption is closer than you think.”

He punctuated his stance on Monday, in a longer post , advocating for the entire “crypto industry” to “… work together instead of tearing each other down.”

Garlinghouse further maintains that he personally owns “… XRP, BTC and ETH among a handful of others (saying that) we live in a multichain world, and I’ve advocated for a level playing field, instead of one token versus another.”

He added: “If a govt digital asset reserve is created — I believe it should be representative of the industry, not just one token …”

Since U.S. President Trump’s inauguration — generally considered a victory by and for the bitcoin industry — a firestorm of debate has ignited as to whether any other digital assets should be included in the proposed reserve, much less “Ripple’s” xrp.

Xrp is a token tailored to enable registered bank, government and individual entities to trade in small or large values of their own national currencies, emulating the cross-border fast settlement features of bitcoin.

Before bitcoin however, such entities were traditionally dependent upon the SWIFT settlement network designed in the 1970s. SWIFT requires days or often longer to achieve final settlement of international transfers, especially for the larger sums more typical to banks and nation-states.

XRP’s “most prominent use case,” says the Bitwise XRP exchange-traded fund (ETF) application, is “the facilitation of cross-border financial transactions” and was for many years touted as a possible “bridge currency,” between nation-states, Investopedia states.

However, this role has become more modernly filled by stablecoins and central bank digital currencies (CBDCs), also according to the Bitwise application. Bitwise is required to inform investors of this factor, as it “could adversely affect the price of XRP and other digital assets,” the disclaimer reads in bold.

Herein lies the dilemma: Many bitcoiners see xrp as the antithesis to fundamental bitcoiner ethos, i.e., the same ethos which resulted in creation of the world’s first-ever decentralized monetary network.

The bitcoin network was designed to eliminate any third-party (i.e., bank or government) involvement whatsoever in currency transactions.

Conversely to bitcoin, xrp delivers control of the network back to these same centralized entities, who also benefit from the bitcoin-inspired model and innovation of international transactions with faster transfer speeds.

Combining this factor with the widely-accepted bitcoiner mantra that “All altcoins trend to zero vs Bitcoin,” the idea of any asset being placed in a reserve alongside bitcoin is not viewed as financially prudent by bitcoin maximalists, and more than a bit insulting.

Bitcoin maximalists traditionally expend lots of time and effort to present why bitcoin is the only digital asset worth holding, both from a long-term investment strategy and human freedoms points of view.

This debate’s most poignant battles are currently being fought on X, between Garlinghouse himself and Pierre Rochard, pro-bitcoin financial planner and founder of the Satoshi Nakamoto Institute. Rochard posted on X Jan. 23:

“The biggest obstacle for the Strategic Bitcoin Reserve is not the Fed, Treasury, banks, or Elizabeth Warren. It’s Ripple/XRP. They are aggressively lobbying against the SBR by throwing around $millions at politicians, desperately trying to derail it. …”

His post led to a public exchange with Garlinghouse, and now countless continued X responses and mounting articles from both bitcoin-only adherents, like Rochard, and a contingent known popularly as “the xrp army.”

In a Jan. 24 article titled “Ripple scores victory against the Strategic Bitcoin Reserve,” Protos cryptocurrency news agency added to the discussion:

“The victory of Ripple-led efforts in politics was also evident in the defeat of not just one but two Bitcoiner-led efforts to establish a BTC reserve.

“Not only is the proposal replaced by a National Digital Asset Stockpile — Bitcoiners’ first failed idea — but the president has also declined to advise the US Treasury to use any funds, such as its Exchange Stabilization Fund or Treasury General Account, to purchase any BTC.”

For context, in July 2024, bitcoiners surprised many Americans by stealing the spotlight and taking center stage during the U.S. presidential race. Then challenger Donald Trump had recently surprised bitcoiners worldwide by flipping his previously stated stance of being hostile towards bitcoin.

While on the campaign trail, Trump made several surprising-at-the-time “pro-bitcoin” promises, including offering his full, unadulterated support to the United States bitcoin mining industry.

Chief among Trump’s promises also, was that he would “commute the sentence of Ross Ulbricht,” whom was long considered by bitcoiners to be a political prisoner.

Ulbricht was sentenced in 2015 to double-life plus 40 years without parole for his crime of building the “Silk Road” website. Silk Road was described as “a dark net eBay style” market which enabled people to spend bitcoin on various items — as mundane as books, music and clothing, but also illegal drugs.

According to various reports, fake ID documents, hacking services, weapons, stolen financial information and other illicit services were also available.

While campaigning, Trump additionally affirmed the right of American citizens to self-custody bitcoin. This was seen as a clear departure from then President Joe Biden’s administration’s cryptocurrency policies at the time.

Collectively known as Operation Chokepoint 2.0, multiple Biden administration laws and actions were then threatening both personal self-custody rights and the American mining, hardware and software wallet, and U.S. dollar-to-bitcoin online banking exchange industries.

Proponents like Garlinghouse correctly argued that these policies were “driving innovation offshore,” and that businesses were leaving the U.S. for friendlier regulatory environments found in places like Dubai, known to be courting the industry.

The now President Trump also promised when campaigning in Nashville to establish a “bitcoin strategic stockpile” (often misquoted or later re-labeled by others as a “bitcoin strategic reserve”) to secure America’s future, to thunderous applause.

Trump followed up with public references to perhaps one day using this bitcoin stockpile to eliminate the U.S. national debt.

Since this bitcoin stockpile campaign promise was announced, Sen. Cynthia Lummis (R-WY), also targeting the national debt she has said many times, revived her proposed BITCOIN Act of 2024 (S.4912).

Related: Bitcoin Act of 2024 | Bitcoin Reserve Bill Referred to Banking Committee

The act seeks “… to establish a Strategic Bitcoin Reserve and other programs to ensure the transparent management of Bitcoin holdings of the Federal Government.”

While Lummis’ proposed bill and Trump’s campaign promise both specify “bitcoin” — with no mention or even hint of other assets or altcoins — on Thursday, Trump did sign an Executive Order (EO) titled “Strengthening American Leadership in Digital Financial Technology.”

Yet, the executive order’s wording of existing to “… support the responsible growth and use of digital assets, blockchain technology, and related technologies across all sectors of the economy …” conspicuously lacks any mention of the word bitcoin.

Instead, the order continues with less specific (to bitcoin) language throughout, like “… United States leadership in digital assets …,” “The digital asset industry …” and “supporting a vibrant and inclusive digital economy and innovation in digital assets …”

The disappointing blow, for those hoping for the immediate establishment of a strategic bitcoin reserve by executive order, came when it was revealed in the EO’s text that rather than a bitcoin reserve being established, only a “working group” was called for, to look into the possibility of a “national digital asset stockpile.”

“The Working Group shall evaluate the potential creation and maintenance of a national digital asset stockpile and propose criteria for establishing such a stockpile, potentially derived from cryptocurrencies lawfully seized by the Federal Government through its law enforcement efforts.”

Two important takeaways here are that:

1) Only the term “stockpile” is ever used by Trump or this EO. Stockpile differs from popular interpretations of the hoped-for and as-yet nonexistent U.S. bitcoin reserve.

As suggested above, the U.S. stockpile consists of keeping assets already in its possession.

A reserve typically includes plans for continued future purchasing of assets — defined by Sen. Lummis’ bill as obtaining “200,000 bitcoin per year” for the U.S. reserve, until totaling 1 million after five years, and with no other assets mentioned in her proposed legislation.

But as reported by Rueters on Friday, “Trump has not said if the government would add to that stockpile by buying more bitcoin in the open market and the order offers no further specific instructions.”

This means that nothing in the current order even signifies a potential future purchasing of any asset — including bitcoin or xrp — again, only that a “working group” is being formed to discuss such.

2) Moving forward, it is clear from the language of the order that all future conversations regarding the establishment of any new national reserve, will now also most likely incorporate the inclusion of potentially multiple cryptocurrency assets.

The order does not specifically call for the large-scale purchasing of assets, however.

But if so, which ones?

Trump himself may have already given a broad foreshadowing of that answer: Stockpile, reserve or no, Trump favors giving special treatment to “tokens created by U.S. companies,” as reported November 2024 by Yahoo! Finance.

In the article, Trump is quoted as hinting at his willingness to remove any capital gains taxes (a feat which actually requires approval of Congress) on any profits made by U.S. citizens investing in “American-made tokens.”

This concept has been greatly magnified by Donald Trump’s son, Eric Trump, who has “dropped a bombshell” confirming the proposal’s inevitability for American digital asset investors, multiple sources report.

Trump’s more recent involvement with his family’s newly established World Liberty Financial (a decentralized financial platform), and advertising “Earn and Borrow Crypto,” shows his predilection (and perhaps self-interest) towards a positive regulatory landscape for the entire industry.

As does his currently trading meme coin, Official Trump, and his prior Trump NFT cards collection.

Whether these tokens are included in the touted digital assets reserve or not, digital assets mined and/or headquartered in the United States are definitely poised to benefit from Trump’s “… proposed policy to eliminate capital gains taxes on U.S.-issued cryptocurrencies,” the Yahoo article states.

There are various online lists of tokens “having strong connections to the U.S.” which include potential candidates for the exemption, such as avalanche, cardano, chainlink, hedera, polkadot, solana, stellar, sui and usdc, as well as probably xrp.

Whether bitcoin could possibly make this same list, thus enjoying capital-gains-tax-free status as well, remains a speculation at present. As of press time, no known news or authoritative sources were currently reporting on such.

But being based in San Francisco, Garlinghouse and others feel that Ripple’s xrp token will definitely be in this tax-free category.

It’s quite natural for Garlinghouse and all observers to assume that inclusion in any “American strategic stockpile/reserve” should also be a given for the asset.

To wit, X user GeorgeVanRijk posted a video (origin uncertain, but presumed to be) of Garlinghouse on Jan. 23, wherein he claimed that there was now “… some talk of a crypto reserve, …. and I think that could wind up including bitcoin and other technologies, which frankly makes sense from a diversification point of view.”

U.Today similarly reported this Friday that Garlinghouse “suggested that this approach could increase the chances of creating a reserve that includes assets like XRP, along with Bitcoin.”

A Jan. 7 post made by Garlinghouse even included a photo together with President Trump and Ripple Chief Legal Officer Stuart Alderoty, held at Trump’s Mar-a-Lago resort, detailing a (debatedly symbolic) beef bourguignon dinner they shared.

Garlinghouse punctuated the post of his photo with the president, claiming it a “Strong start to 2025!” This prompted outlets to ponder “what’s cooking?” between the two.

The inference was that Garlinghouse’s celebratory business dinner and public posts were meant to signify that he, Ripple and xrp were officially “in the club” and that they had allegedly come to some sort of business arrangement with Trump.

Xrp’s price responded positively after this speculative initial flurry of reports, moving from the low-mid $2 range to a new modern-era high of $3.38 in just over a week’s time following the meeting on Jan. 16, seeing the digital asset’s price move to above $3 for the first time since January 2018.

However, Garlinghouse may himself have ruined the very opportunity afforded him by the press photo, the dinner and his token’s “Made in USA” status by supporting Democratic presidential candidate Kamala Harris in the recent presidential race.

Garlinghouse gave “… over $11.8 million to PACs supporting the Harris campaign, making him one of the crypto industry’s largest individual donors this cycle,” CNBC reported in October 2024, and that “The Trump PAC has raised about $7.5 million crypto donations since early June.”

Recent unconfirmed reports on the relationship between Trump and Garlinghouse do not seem to be as congenial as onlookers might surmise, based upon what Garlinghouse has most recently portrayed, however.

X user @ghost_prick contrarily posted on Jan. 17, saying that Trump has allegedly criticized Ripple for backing Harris.

Unconfirmed rumors report that the exchange between them was allegedly even more tense than described; however, Ripple’s Alderoty has denied the rumors of a clash as “baseless” and “pure fiction.”

The post elicited over 200 responses however, including one from user @Decentral97:

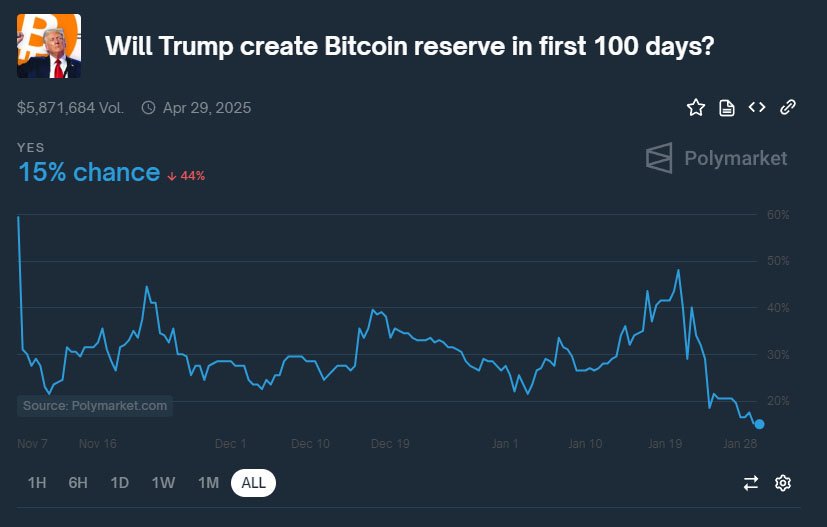

As of Jan. 27, the betting website Polymarket, which accurately forecast Trump’s election victory, placed the odds of Trump creating a “Bitcoin reserve in (his) first 100 days” at only 15%, down from a reported 64% odds on Jan. 20, Inauguration Day.

Polymarket also reported the chance of a U.S. XRP reserve happening in 2025 to be at 18%, down from a previous high of a 46% chance, reported on Jan. 20.