South Dakota lawmakers killed a bill that would have allowed the state to invest in bitcoin.

The bitcoin reserve bill, HB 1202, would have allowed the state to allocate up to 10% of its public funds to bitcoin as part of an investment strategy. But concerns over the digital asset’s volatility and lack of regulations killed the proposal.

Despite that, the bill’s sponsor Representative Logan Manhart said this isn’t the end and that he’ll try again in 2026.

On February 24, the South Dakota House Commerce and Energy Committee deferred HB 1202 until the 41st legislative day. Since the state has only 40 legislative days, that effectively killed the bill for the year.

Manhart introduced the bill on January 30 saying adding bitcoin to the state’s investment portfolio would help protect funds from inflation.

“It’s a commonsense update to South Dakota’s investment strategy by allowing a limited allocation of state funds into alternative assets that have consistently proven to preserve value,” he said according to South Dakota Public Broadcasting.

But state officials weren’t convinced.

Matt Clark, South Dakota’s State Investment Officer said bitcoin is too volatile and has no inherent value. He said, “Bitcoin does not have any underlying physical use. It does not generate income, much like commodities or other kinds of assets.”

The committee voted 9-3 to not move the bill forward.

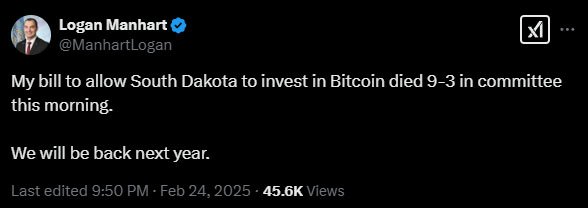

South Dakota is following in the footsteps of Montana where lawmakers recently rejected a bitcoin reserve bill.

Montana’s House Bill 429 which would have allowed the state to invest $50 million in digital assets failed 41-59. Other states like Wyoming and North Dakota have also stalled similar Bitcoin investment bills.

But despite these rejections, bitcoin reserve bills are still alive in several states. Florida, Arizona, Utah, Texas and Missouri are among the states considering legislation that would allow public funds to be invested in bitcoin.

The biggest reason the bill died was the risk associated with bitcoin’s price swings. Lawmakers were hesitant to invest taxpayer money in an asset known for its unpredictability.

The same day the bill was killed, bitcoin’s price dropped below $90,000 falling 6% amid broader market concerns.

Regulatory uncertainty was also a big factor. Lawmakers didn’t want to invest in bitcoin without clear federal guidelines. The US government is talking about regulating digital assets but the landscape is still unclear. Many wanted to wait for more stability before moving.

Though it did not pass this time, Manhart isn’t done. He said, “We will be back next year.”

South Dakota is playing it cautious but the interest in state-held bitcoin isn’t going away. As more institutions and private companies are buying bitcoin, the debate will continue on whether governments should too.